"A couple of others, however, suggested that the juxtaposition of higher core inflation and somewhat lower unemployment could imply that the level of potential output was lower than had been thought."The economy grew 0.7% in the first six months of the year, and we are still below the previous peak, but we're close to potential output?! My guess is that "the couple of others" includes Plosser. In other words, this guy thinks that around 9 percent unemployment is close to the natural rate. Nothing like believing that anything is full employment to convince yourself that markets actually produce optimal outcomes.

Wednesday, August 31, 2011

Plosser thinks there is no jobs problem

Monday, August 29, 2011

Alan Krueger to lead the CEA

The NYTimes reports that Alan Krueger will be the next chairman of the Council of Economic Advisors. A well respected, serious professor from Princeton, that almost everybody from Mankiw to Krugman will approve of. He is a labor economist, and yes that is a problem. My concern with labor economists, is that they tend to think in microeconomic terms when it comes to employment creation, and that is definitely not a solution for the current situation.

For example, the Times tells us that:

"Dr. Krueger was also one of the administration’s chief spokesmen for a payroll tax cut designed to encourage employers to hire, a policy that was in effect under the HIRE Act during 2010. The tax incentive, which was designed by Senators Chuck Schumer and Orrin Hatch after a raft of competing proposals floated through Washington, was criticized by some economists as being too small and ill-targeted to make much of a difference in hiring."Don't get me wrong a reduction of payroll taxes, a regressive tax that burdens low income groups more heavily, is a good idea. But the reason is that it would stimulate consumption, not that it would reduce costs and lead to additional hiring. Why would a firm hire workers, because costs are lower, if they don't have demand for their products? Employment creation is NOT about incentives to the supply side, but about creating more demand!

Sunday, August 28, 2011

Bernanke at Jackson Hole

"In light of its current outlook, the Committee recently decided to provide more specific forward guidance about its expectations for the future path of the federal funds rate. In particular, in the statement following our meeting earlier this month, we indicated that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013."In other words, short-term rates will remain low. On long-term rates (i.e. quantitative easing) he said nothing. Worse, his comments on fiscal policy were terrible. He said:

"To achieve economic and financial stability, U.S. fiscal policy must be placed on a sustainable path that ensures that debt relative to national income is at least stable or, preferably, declining over time. As I have emphasized on previous occasions, without significant policy changes, the finances of the federal government will inevitably spiral out of control, risking severe economic and financial damage."Can you imagine if in 1937-38 (the Roosevelt recession) the concern would have been with not allowing the debt-to-GDP ratio to grow. Why? Does Bernanke know anything about a magical number above which the debt-to-GDP ratio has a negative impact on the economy? Has he accepted the Rogoff-Reinhart view that beyond 90% we are doomed? The size of debt in domestic currency with respect to GDP is irrelevant, and shouldn't be a concern.

At any rate, it seems that between congressional Republicans and Obama fiscal stimulus is off the table (in fact, expect fiscal contraction), and monetary policy is wait and see with no radical measures. So the economy will continue to stagnate. As Christina Romer said we're "pretty darned f_cked!"

PS: I'll say more on Rogoff-Reinhart in another post.

Saturday, August 27, 2011

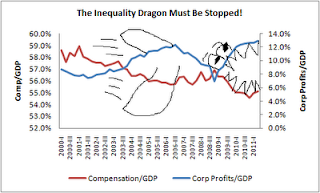

Inequality monster

So Steve tells me I have competition in the art the department. I think I lost. Great graph by Jared Bernstein, ex-advisor to Joe Biden, and the only truly heterodox economist they had in the White House. Sadly he is not there any more.

The only thing is that this graph shows only short term fluctuations in corporate profits. Pretty cool anyway.

Friday, August 26, 2011

C'mon, Paul, you can get there!

Professor Krugman seems to be undergoing an (structuralist?) epiphany. Or at least admitting it in public.

What am I talking about? My perception of his movement toward recognizing macro foundations as the driving force in reality and any model that presumes to approximate it.

Evidence?

This piece, in which he says "pah...all that micro trade theory doesn't have anything to do with reality." He doesn't really say that, I am imputing that. Here's what he did say "The case for free trade is about microeconomics, about raising efficiency. There’s no particular reason to think that trade liberalization is good for fixing problems of inadequate demand."

And this piece, (which I promise to find) in which he admits to becoming increasingly interested in macro somewhere in the 90's.

And he's almost there...,almost as in this piece, where he, among others, takes Barro to task for his ridiculous labeling of micro as "regular economics," implying that, well, read the piece.

So, Paul, keep going, you are on the road to the promised land. We're really happy that you got your Nobel for micro trade theory...that wonderful event appears to have freed you to follow the path of truth. Now just take the final step and follow Vernengo et al. into explaining microeconomics using macro foundations.

What am I talking about? My perception of his movement toward recognizing macro foundations as the driving force in reality and any model that presumes to approximate it.

Evidence?

This piece, in which he says "pah...all that micro trade theory doesn't have anything to do with reality." He doesn't really say that, I am imputing that. Here's what he did say "The case for free trade is about microeconomics, about raising efficiency. There’s no particular reason to think that trade liberalization is good for fixing problems of inadequate demand."

And this piece, (which I promise to find) in which he admits to becoming increasingly interested in macro somewhere in the 90's.

And he's almost there...,almost as in this piece, where he, among others, takes Barro to task for his ridiculous labeling of micro as "regular economics," implying that, well, read the piece.

So, Paul, keep going, you are on the road to the promised land. We're really happy that you got your Nobel for micro trade theory...that wonderful event appears to have freed you to follow the path of truth. Now just take the final step and follow Vernengo et al. into explaining microeconomics using macro foundations.

Wednesday, August 24, 2011

The meaning of structuralist macroeconomics

As the agricultural sector's size decreases, and its productivity increases, and workers migrate from rural to urban areas, the price of foodstuff goes up, and wage resistance by workers implies that costs increase in general. In other words, inflation resulted from the transformation of the structure of production. Hence, the term structuralism, that at the same time, in 1950s, was being popularized by Claude Levi Strauss. Structuralism in Latin America was, as a result, a response to Monetarist views of inflation, and seemed to be aligned with Keynesian economics.

However, there is a more profound meaning to structuralism. Levi Strauss argued that science proceeds in two ways; it is reductionist when the object of analysis is simple, and it is structuralist when it deals with complex systems. I tend to believe that a more productive understanding of social sciences should not distinguish between simple and complex phenomena, but emphasize the difference between methodological individualism and structuralism, that is, the presumption that one cannot understand social behavior unless one understands individual behavior, and the counter-argument that individual behavior is by definition constrained by social relations.

In that sense, classical authors (surplus approach), that emphasized the role of class as a central determinant of individual behavior, and Keynes, whose belief in the fallacy of composition implied that the whole is more than the aggregation of its parts, would be structuralists. For example, it might seem reasonable to assume that an individual worker would accept to work for a lower wage in order to find a job, but if lower wages in the whole system lead to lower demand and a reduction in labor demand, the individual firm reducing wages, and the individual worker accepting it may not solve the problem. One has to understand the functioning of the system as whole first, in order to understand how the individual parts interact. Or put it simply one needs macro-foundations for microeconomic behavior, not the other way round.

PS: The classic book on macroeconomic structuralism in the anglo-saxon world is Lance Taylor's one (image above). A simple intro to structuralism in Spanish and Portuguese was the book by Carlos Lessa and Antônio Barros de Castro, the latter sadly passed away last Sunday.

Monday, August 22, 2011

One graph is worth...

The graph below shows the relation between the percentage change in hourly wages across all sectors of the economy in local currency adjusted for inflation and real GDP growth between 2003 and 2011 (last year is obviously a forecast), using data from the Economic Intelligence Unit (EIU, access is restricted).

Even if one does not completely trust the data on real wage growth in China and India, or the relevance of real wages (considering the size of informal markets) in developing countries when compared to the developed countries closer to the axis like France, Germany, Japan and the US. But clearly one way out of the crisis is to redistribute income, and promote a healthier increase of real wages and domestic demand.

Even if one does not completely trust the data on real wage growth in China and India, or the relevance of real wages (considering the size of informal markets) in developing countries when compared to the developed countries closer to the axis like France, Germany, Japan and the US. But clearly one way out of the crisis is to redistribute income, and promote a healthier increase of real wages and domestic demand.

Sunday, August 21, 2011

Heinz Kurz on the state of the dismal science

"Economics may be a dismal science or discipline, but its present dismal state applies not to the discipline as a whole or to all traditions of economic thought available. It applies to the neoclassical mainstream and especially to NCE [New Classical Economics]."It is the notion of an economic system that automatically tends to full employment that makes ours a dismal science, but that is NOT a general, even if it is dominant, view in the profession.

Saturday, August 20, 2011

Investigación Económica at 70

PS: A partial list of the conference participants includes Amitava Dutt, Anthony Thirlwall, Carlo Panico, Guadalupe Mántey, Tom Palley and Jaime Ros among others.

Thursday, August 18, 2011

More fiscal stimulus or an Infrastructure bank?

Federal budget deficits in this situation are like IV-bags in an emergency room: they stabilize things. IV's are definitely linked to sickness, and no one would use them if they weren't necessary. But very few doctors propose to cut back on saline while the patient is still sick. Today, however, the official economists and their followers in Congress, the White House and the media are divided between those who would remove the IV's slowly, whether the patient recovers or not, and those who'd like to charge through the wards, yanking needles from arms. The debt deal enacted earlier this month put the first group in charge, but that's pretty cold comfort.

The solution is not another "stimulus" — a term that stinks of needles and quick fixes. The solution has to be a long-term strategy: both a new direction for economic activity and new institutions to provide the money. The proposed national infrastructure bank — a permanent institution — is the right sort of thing and would be a good place to start.Both the IV analogy, and the need for a radical departure from conventional solutions are right on the money. I would add, however, that we do not need to wait for the infrastructure bank, since the Fed can and should do it. As Jerry Epstein (2006) has shown, in the past central banks have provided subsidized credit for industrial activities, and have acted as agents of development. So rather than wait for institutional innovation, current institutions can be put to work immediately.

Tuesday, August 16, 2011

On investment and taxes

To follow up on Matias' last post, with all of this talk about taxes and job creators, it is worth thinking through the effects of taxes on the decision by firm to invest in new plant and equipment (thus creating jobs). Thinking through the baseline scenario, it is not immediately obvious why a capital gains tax (or even a profits tax) would discourage investment. The investor (firm) only gets taxed on gains (profit) so unless the tax is 100 per cent, they still make money. It would be hard to find a successful businessman who chooses not to make money! Of course, other costs may imply that the world is a little more complicated.

In addition, it is well known in the empirical literature on investment that the decision by to firms to expand productive capacity is quite insensitive to the cost of capital and quite sensitive to current and expected demand for the firm's output. Taxes, along with interest rates, the price of equipment, and other items form the total cost of capital. Thus, taxes are a (small) component of a group of costs that really don't matter!

Not only that, but if the taxes are on capital gains, they matter even less! In general, firms finance investment out of retained earnings first, loans second, and issuing new equity third. That is, the stock market is the last resort in paying for new plant and equipment. This is because issuing new shares may dilute the value of existing shares, and may signal to markets that the firm doesn't have the ability to finance investment out of profits and can't get a loan. So firms are particularly insensitive to stock markets! This suggests the very often, the stock market is but a sides show - a very large casino that has little to do with productive investment.

Finally, if it is the case that investment is pretty I insensitive to taxes (particularly those on capital gains) and the tax revenues are spent on the output firms (perhaps via unemployment insurance or welfare payments), we may have a large "balanced budget multiplier." In other words, we end up taking savers and transferring it to spenders, thus encouraging economic expansion. It is then likely the case that taxing the "job creators" actually creates jobs!

In addition, it is well known in the empirical literature on investment that the decision by to firms to expand productive capacity is quite insensitive to the cost of capital and quite sensitive to current and expected demand for the firm's output. Taxes, along with interest rates, the price of equipment, and other items form the total cost of capital. Thus, taxes are a (small) component of a group of costs that really don't matter!

Not only that, but if the taxes are on capital gains, they matter even less! In general, firms finance investment out of retained earnings first, loans second, and issuing new equity third. That is, the stock market is the last resort in paying for new plant and equipment. This is because issuing new shares may dilute the value of existing shares, and may signal to markets that the firm doesn't have the ability to finance investment out of profits and can't get a loan. So firms are particularly insensitive to stock markets! This suggests the very often, the stock market is but a sides show - a very large casino that has little to do with productive investment.

Finally, if it is the case that investment is pretty I insensitive to taxes (particularly those on capital gains) and the tax revenues are spent on the output firms (perhaps via unemployment insurance or welfare payments), we may have a large "balanced budget multiplier." In other words, we end up taking savers and transferring it to spenders, thus encouraging economic expansion. It is then likely the case that taxing the "job creators" actually creates jobs!

Warren Buffett on job creators

"Back in the 1980s and 1990s, tax rates for the rich were far higher, and my percentage rate was in the middle of the pack. According to a theory I sometimes hear, I should have thrown a fit and refused to invest because of the elevated tax rates on capital gains and dividends.

I didn’t refuse, nor did others. I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off. And to those who argue that higher rates hurt job creation, I would note that a net of nearly 40 million jobs were added between 1980 and 2000. You know what’s happened since then: lower tax rates and far lower job creation."Of course this involves actual evidence, which is irrelevant for the discussion about economic policy with Republicans these days. In their view, Warren Buffett is a job creation denier.

Monday, August 15, 2011

Krugman believes the US economy is wage-led

"at a national level lower wages would almost certainly lead to fewer jobs — because they would leave working Americans even less able to cope with the overhang of debt left behind by the housing bubble, an overhang that is at the heart of our economic problem."Which by the way, also means that soaking the rich, because they are job creators, makes a lot of economic sense. It should be no surprise that jobless recoveries became common in the period in which real wages have stagnated!

Sunday, August 14, 2011

I know, I know, I should be grading (or working on my diss), but c'mon Mr. President, 400K jobs a month!

A 1932 Low cartoon via Luke Ashworth via Worthwhile Canadian Initiative.

I promise I am grading, but Ken Rogoff was just sounding like a total idiot (sorry, nothing pejorative intended for those who truly deserve our support) arguing (need I even add badly?) with Paul Krugman on Fareed Zakaria's GPS. So I can't help myself.

We do need to do whatever possible to shake this President out of his torpor. Here is the beginning of a campaign I just posted on Economist's View, and will be posting wherever there are smart readers. Quoting

"C'mon Mr. President!!! 400,000 jobs a month. Private, public, we need them all. If Plouffe and Daley disagree, tell them to get with the program.

Friday, August 12, 2011

Bob Pollin on the failure of the fiscal stimulus

A nice paper by Bob Pollin on why the American Recovery and Reinvestment Act (ARRA) failed to produce a vigorous recovery. In his view:

"I advance three reasons for the failure of the ARRA to achieve a strong recovery: 1) The ARRA relied too heavily on tax cuts as a means of bolstering private spending; 2) Household wealth declined dramatically during the recession, tied to the collapse of the financial bubble. This in turn weakened the willingness of households to increase spending; and 3) Credit markets were locked up, especially for smaller businesses, despite the highly expansionary monetary policy stance adopted by the Federal Reserve. Building on these findings, I finally develop a series of policy proposals aimed at promoting both a strong recovery in the short term and at reducing any remaining structural deficit issues in the longer term. The short-term program focuses on extending loan guarantees, especially to small businesses; and taxing the excess reserves held by commercial banks. The longer-term agenda focuses on reducing government costs for health care and the military, and on increasing revenue through establishing taxes on financial market transactions."The whole paper here.

Thursday, August 11, 2011

Deep double dip thoughts

"the odds of a double dip over the coming year are uncomfortably high, perhaps as high as 50%."Before you take them too seriously remember that they also say a few lines down that:

"the thoughtlessness of the debt deal—notably its failure to tackle any of the real sources of America’s fiscal problems, such as entitlement spending—raises a bigger worry."As everybody knows that the fiscal problems result from the recession, Bush's tax cuts, and the two wars, they are just deliberately ignoring the truth, or worse, blissfully unaware of what's going on. The worry is not about the fiscal situation, and that is why markets have rushed to buy Treasuries in the middle of the crisis this week, after the S&P downgrade (Bob Kuttner got it right, those guys are just Triple-A idiots). I won't even talk about Ken Rogoff's argument (in the Financial Times) that "the biggest deficit is not in credit, but credibility" [is there a credibility fairy too?].

In truth, as noted (subscription required) by Joe Stiglitz in the Financial Times, at core this is a political crisis. Both in the US and in Europe the inability of the political elites to cope with the crisis, implies that fiscal stimulus (and in Europe not even low rates of interest on public debt for the periphery) is not in the horizon. In other words, more than a double dip, since the recovery was never really very strong, we'll remain in a limbo of stagnant growth in the center. Japan redux.

However, does that mean that we'll have another Lehman moment with a collapse of financial markets, and the collapse of trade, hurting the strong recovery in the periphery? That is less likely, but not an impossible scenario. Note that last time, the collapse in trade had significant impact in the economies of the periphery. This suggests that more mechanisms to maintain South-South trade going in case of a collapse of the financial system in the center might be a good idea.

PS: Dean Baker argues that the recent stock market panic is related to a possible Lehman moment coming from the on going European debt crisis.

Wednesday, August 10, 2011

More on FT's negative propaganda on Argentina

I had promised to return to the issue of inflation in Argentina, in my previous post about the Financial Times' biased coverage of the Argentine boom post-default and devaluation in 2001-02. The important question, and not only in the Argentine case, is whether inflation is somehow associated to excess demand, which would justify the conservative calls to cool down the economy and promote tighter monetary and fiscal policies. The graph below shows average capacity utilization in the Argentine economy, and it clearly shows that since 2006 the levels have reached the normal position close to 80% of utilization.

The same can be seen in the measure of the output-to-capital ratio presented below. In other words, investment has allowed capacity to adjust to demand, and the level of the Y-K ratio to return to its normal level. In other words, the boom has allowed the economy to recover normal levels of capacity utilization, and if the economy grew at a faster pace, capacity would have most likely adjusted. The only way that the economy would reach full capacity would be if the rate of growth of demand was considerably faster than the ability of capacity to adjust. From 2003 to 2010 GDP (proxy for demand) grew around 60%, while investment did 147% (the adjustment of capacity), on a cumulative basis. Also, even though unemployment fell from close to 25% to around 7.5%, there is space for lower levels of unemployment, something that is particularly in an economy with significant numbers of employees underemployed, or employed in low productivity activities.

The real danger, as always for developing and peripheral countries, comes from the balance of payments. The graph below shows the current account to export ratio. Clearly the space to grow without reaching the external restriction has shrunk during the boom, approaching zero in 2011, but the limit has still not been reached. This would be a limit, but not a capacity limit.

In sum, inflation cannot be associated with excess demand, since the evidence does not support that the economy is above maximum capacity. Further, well understood what I'm suggesting is that capacity does adjust to demand, so inflation in normal times (exclude wars and other catastrophic events) is related to cost pressures. I'll deal with the evidence for commodity prices, and distributive conflict in another post.

Monday, August 8, 2011

FDI and Economic Development

In the 1960s Foreign Direct Investment (FDI) and Transnational Corporations (TNCs) were seen, at least by progressives, as an obstruction in the process of economic development. The ultimate critique was that not much of the technological development introduced by foreign firms diffused to other parts of the economy, and that profit remittances would become a burden on the balance of payments accounts. Hence, TNCs were seen as signs of the exploitation of the South by the North. It did not help that companies, like International Telephone and Telegraph (ITT) in Chile during the Allende government, were plotting to bring down democratically elected governments. Everything about foreign capital was bad.

By the 1990s, after a lost decade and the victory of the Washington Consensus Decalogue, foreign capital and TNCs were seen as central for economic development. FDI created jobs, increased productivity, and macroeconomic problems associated to the balance of payments accounts were seen as secondary, since export performance, within the context of an export-led development strategy, would reduce the possibilities of crises. Everything about foreign capital was good.

Read the rest here.

By the 1990s, after a lost decade and the victory of the Washington Consensus Decalogue, foreign capital and TNCs were seen as central for economic development. FDI created jobs, increased productivity, and macroeconomic problems associated to the balance of payments accounts were seen as secondary, since export performance, within the context of an export-led development strategy, would reduce the possibilities of crises. Everything about foreign capital was good.

Read the rest here.

Tuesday, August 2, 2011

Why the euro is NOT the dollar

Nope, it's not because the ECB will not do the equivalent of quantitative easing, and because it allows the interest rates of euro denominated bonds in the periphery to go to the stratosphere, even though those things don't really help. It is because intra-european fiscal transfers are not large enough. The Economist has an interesting article in the last issue that shows intra-state transfers in the US.

Delaware transfers to the Union more than 200% of its own GDP, while New Mexico receives more than 250% of its own GDP in federal transfers (the difference of taxes paid to federal spending within the respective States). That is fiscal federalism.

Monday, August 1, 2011

Economists for Edwards

"I am jumping the gun as this has not yet been publicly announced, but on Sunday about half of the former group, "Economists for Edwards," agreed at the urging of James Galbraith and Clyde Prestowitz to endorse Barack Obama for president. A condition of this, which I insisted on as a condition for signing on, was that it be made clear in our statement that we would be working to change some of Obama's policy positions, particularly on health care and social security, to become more like those supported by Edwards."Well, how did that work? From the debt-ceiling agreement, not very well. This agreement is as anti-Keynesian as it could be. It will involve cuts, cuts and cuts. It's not clear that this even classifies as an intellectual surrender, since it seems that Obama never really understood basic Keynesian economics in the first place. It looks increasingly important to have an alternative to the left in next year primaries.

Subscribe to:

Posts (Atom)

Keynes’ denial of conflict: a reply to Professor Heise’s critique

Tom Palley reply to response about his paper on Keynes lack of understanding of class conflict. In many ways, this is how Tom discusses Ke...

-

"Where is Everybody?" The blog will continue here for announcements, messages and links to more substantive pieces. But those will...

-

There are Gold Bugs and there are Bitcoin Bugs. They all oppose fiat money (hate the Fed and other monetary authorities) and follow some s...

-

By Sergio Cesaratto (Guest Blogger) “The fact that individual countries no longer have their own currencies and central banks will put n...

Listen to your economists, present and former. Romer in particular is showing the right brand of spunk ... watch her Bill Maher appearance... and has the economics right. Sperling has both the politics and the economics right. 400,000 pragmatic jobs a month. Hell or high water. You're the President. C'mon.

Here's just one of many links to Romer (this one from HuffPo):

Send the kids out of the room."

I am actually beginning to like Christy Romer in spite of past peccadilloes.

Ok, back to grading, but not before I pose a related question: How is that austerity thing going after the riots this week Mr. Prime Minister Cameron?