Certain things have to be said again and again because some people keep repeating lies until they become credible. The New Deal did work (see here)! Unemployment did fall significantly, and when they tried fiscal adjustment in 1937 (fall in expenses associated with pensions for WWI veterans, and new taxes associated to the Social Security Act) the economy contracted. There is a reason why everybody in the profession became a Keynesian in the 1940s; because it worked, and the war economy was the ultimate proof of it.

In Lucas' view, recovery depends on the confidence of businessmen. The question that people that believe in what Krugman aptly calls as the Confidence Fairy have to reply is why would businessmen invest if the economy is in the dumpster, and there is no demand for their goods, let alone to create new capacity by buying machines! And should I also add that the evidence for investment is that it follows output?! Logic and evidence have no relation with the sort of stuff Lucas believes, and he should not be taken seriously.

I'll quote again Marriner Eccles, the chairman of the Fed during the Depression, and a Republican from Utah, on the subject of confidence. He said:

"Confidence itself is not a cause. It is the effect of things already in motion. (...) What passed as a 'lack of confidence' crisis was really nothing more than an investor's recognition of the fact that new plant facilities were not needed at the time."And Eccles actually knew a thing or two about running real businesses. Put clearly, lack of confidence is the result of lack of demand. We need more stimulus, and confidence will return.

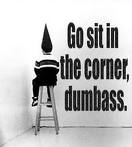

Lucas had a poisonous effect on the profession, leading it back to the dark ages of macroeconomics. He wants now to push the same sort of inane idiocy in the policy arena. He suggests that the slow recovery results from Obama's European style social democratic programs! Next thing he'll say that Obama is Kenyan. Lucas and the New Classical Rational Expectations (and RBC) School are the intelligent design of economics. They should have the same status in the scientific community.

By the way, he got a Sveriges Riksbank prize in 1995. That tells you the sorry state of our profession.

ReplyDelete