Did macroeconomics give up on explaining recent economic history?-- Simon Wren-Lewis on the Phillips Curve, the time varying NAIRU, Cowles metrics versus VARs and more. ROKE published a paper by him a while ago

Sunday, April 29, 2018

On the Blogs -- The Macro Edition

Friday, April 27, 2018

The Italian crisis in historical perspective

In one graph. Source is this twitt from Gennaro Zezza. Real consumption per capita, not GDP (just making sure nobody gets confused).

Note that while the crisis is considerably less profound (right axis for the current one), it is already going to be considerably more prolonged. Not sure what's worse really.

Note that while the crisis is considerably less profound (right axis for the current one), it is already going to be considerably more prolonged. Not sure what's worse really.

Wednesday, April 25, 2018

The Wall Street Journal and the future of Greece

Greece’s Business Prospects Brighten After Lost Decade. Or so says the Wall Street Journal. I fail to see how. And the graph below is their illustration.

Note that the reason for the brighter situation is merely that it has stopped falling. I had a similar graph not long ago comparing it just with the Depression in the US.

Note that the reason for the brighter situation is merely that it has stopped falling. I had a similar graph not long ago comparing it just with the Depression in the US.

Sunday, April 22, 2018

On the blogs - Labor Theory of Value (LTV) Edition

Marx’s Refusal of the Labour Theory of Value-- David Harvey on Marx and the LTV

Marx’s law of value: a debate between David Harvey and Michael Roberts-- Michael Roberts reply to the post above (Harvey's further response is also linked)

Sraffa and Marxism or the Labor Theory of Value, what is it good for?-- old post by yours truly, which I offer (for now) in lieu of an actual post on the above debate, since I think there are problems with both views

Wednesday, April 18, 2018

Business Cycles in the Modern World System: Past, Present and Future

In case anybody is in the area around New York, the Program of the PEWS conference below.

Thursday, April 26, 2018 -- 4:30 - 5:20 p.m.

Reception in the DiMenna-Nyselius Library Room 107 C

5:20 p.m.

Formal Opening of the Conference Library Multimedia Room

Welcome: Eric Mielants (Sociology)

Katsiaryna Salavei Bardos (Finance)

Introduction of Keynote Speakers

Dean Greenwald (CAS)

Immanuel Wallerstein (Sociology, Yale University)

“Cycles Within Structures versus Structural Crises”

Matías Vernengo (Economics, Bucknell University)

“From Financial Instability to Secular Stagnation”

Friday, April 27, 2018

9 – 10:30 a.m. DiMenna-Nyselius Library Multimedia Room

Panel 1: Theoretical Models and Business Cycles

Moderator: Michael Puleo (Fairfield University)

Daniel H. Neilson (Bard College at Simon's Rock)

“Minsky, Polanyi, and World System Analysis”

Daniel Gugan (Corvinus University of Budapest)

“An embedded-systems approach to the socio-economic cycles of the world system”

Roberto J. Ortiz (Binghamton University)

“The Nature and Limits of Endless Accumulation”

10:45 a.m. – 12:15 p.m.

Panel 2: Business Cycles confronting Social and Political Trends I

Moderator: Kathy Nantz (Fairfield University)

Tarun Banerjee (University of Pittsburgh)

“The Great Recession and Corporate Responses to Social Movements in the US”

Chungse Jung (Binghamton University)

“Long-Term Capitalist Dynamics and Protest Waves in the Global Periphery: A Critical Reappraisal of Business Cycles”

For more information go here.

Tuesday, April 17, 2018

Corporate tax cuts use in one graph

So it seems that a good chunk of the GOP/Trump tax cuts will go to buybacks, and to fuel the bubble in the stock market, according to Robin Wigglesworth in the FT (subscription required). Bad news for those that think that higher earnings lead to higher investment (meaning gross formation of capital). My impression is that if you want tax cuts to be stimulative, you should target consumption, in particular for lower income groups, which tend to spend a higher proportion of their income.

Sunday, April 15, 2018

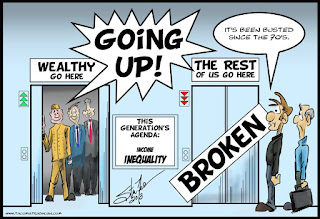

On the Blogs—The Inequality Edition

Why So Few American Economists Are Studying Inequality—Alana Semuels at the Atlantic provides a nice summary of the problems in the profession, and cites the work by a few economists like Jamie Galbraith and the two cited below (Milanovic and DeLong)

Chinese income distribution in 2002-3 and 2013—Branko Milanovic on how Chinese inequality, did not increase much in that period, even though it is high, and how it converged to the US levels

Globalization: What Did Paul Krugman Miss?—Brad DeLong more on globalization really, but there again, globalization has been at the core of the debates on inequality (how much it hurt the Rust Belt here, or how it raised incomes in the South, China and India mostly)

Subscribe to:

Comments (Atom)