Frankly, it's a bit boring. But every time you show the actual data on Argentina's growth someone says it's just good luck. The terms of trade boom. Data below compares terms of trade in Argentina and Brazil in the same period, 2003-12 (Kirchner-Kirchner and Lula-Dilma).

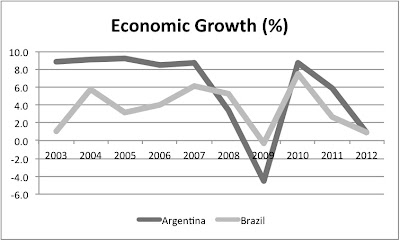

Not very different, and if something terms of trade improved a little bit more in Brazil (33% against 22% approximately, for the whole period). Note that metallic commodities (Brazil is a big exporter of iron ore) increased more than agricultural goods (both Brazil and Argentina are big exporters of soybean and derived products, for example). So did Brazil grew more than Argentina, which is what you would expect if external conditions determined growth? See graph below.

As it turns out Argentina grew 5.8% against 3.6% in Brazil. Further Brazil has a larger current account deficit. Fiscal and monetary policy were more expansionary in Argentina, and the nominal and real exchange rates more devalued. Let alone that the average real wage grew more in Argentina. So no it was NOT all external conditions.

Can we please, pretty please, with sugar on top, stop just venting prejudices and get the data before we talk. You are entitled to be against the policies of the government, you might even be for the policies of the Washington Consensus (people have defended crazier ideas). But, as Daniel Patrick Moynihan used to say, you are not entitled to your own facts.

Not very different, and if something terms of trade improved a little bit more in Brazil (33% against 22% approximately, for the whole period). Note that metallic commodities (Brazil is a big exporter of iron ore) increased more than agricultural goods (both Brazil and Argentina are big exporters of soybean and derived products, for example). So did Brazil grew more than Argentina, which is what you would expect if external conditions determined growth? See graph below.

As it turns out Argentina grew 5.8% against 3.6% in Brazil. Further Brazil has a larger current account deficit. Fiscal and monetary policy were more expansionary in Argentina, and the nominal and real exchange rates more devalued. Let alone that the average real wage grew more in Argentina. So no it was NOT all external conditions.

Can we please, pretty please, with sugar on top, stop just venting prejudices and get the data before we talk. You are entitled to be against the policies of the government, you might even be for the policies of the Washington Consensus (people have defended crazier ideas). But, as Daniel Patrick Moynihan used to say, you are not entitled to your own facts.

Good stuff. I find the strange international consensus on Argentina rather intriguing. I've been here for two months now and can't see the economic disaster-zone that neoliberal commentators seem to have identified. You'd almost think they'd never been here. http://emergenteconomics.com/2013/02/23/argentinas-andean-inflation-rate/

ReplyDeleteIt is a little bit disingenuous (dishonest?) to start the graphs in 2003 because it makes it look like Argentina was not bouncing off from a big drop in output.

ReplyDeleteI do not understand what you mean with real exchange rate being more devalued in Argentina. How do you compute that? I am just curious.

Dear Anonymous, I think you are out of line calling me dishonest. First, the previous post shows growth going all the way back to 1946 (1946-2012). Growth was higher in the sub-period 2003-2012). Then somebody says that the high growth in the last boom (2003-2008) is only caused by external conditions. SO I ONLY SHOW THE POST-CRISIS PERIOD FOR THAT REASON. It's not dishonest. It's plain logic that to show that the positive terms of trade shock is NOT the only cause behind the boom I show only the boom period. How relevant would be the previous period for that?

DeleteThe data on the exchange rate I have discussed several times, and can be shown using again Ferreres data. If you want it send an e-mail to vernengo@economics.utah.edu and I'll send you the data.

That is not that difficult to understand. If your comparison starts in 2003, you are including the period of the bounce back from the crisis. You should compare peak-to-peak or trough-to-trough. Otherwise it is apples and oranges.

ReplyDeleteThe terms of trade shock is indeed not the only factor, but it looms large. The other important factor is the bounce back from the crisis.

I am not sure you understood the question. What do you mean with Argentina's real exchange rate being more or less appreciated than Brazil's one? I do not think that statement makes economic sense. Even if you could compare the level of the real exchange rates in two countries, why would it be good to have the least appreciated currency?

Again average rates (which smooth out peaks and throughs) for a long period like the one in the first graph 1946-2012 deal with that matter. And it is really preposterous to think that the average rate of 5.8% for a whole decade is a bounce back from the crisis.

DeleteThe fact is that Argentina and Brazil grew more in the pre-1980s period because of the State-led policies, and the retreat from neoliberalism has allowed for growth, stronger in Argentina because the retreat from neoliberalism was stronger. I suggest you read the post and paper by Esteban Perez in the blog on why the data on cycles shows that LA grows less because of its tendency to use contractionary policies.

Finally, it's obvious that I was referring to changes in an index. Like the terms of trade is made 100 in 2005 so is the case with the real exchange rate. And for the period in question the Argentine one is more devalued.

“Again average rates (which smooth out peaks and throughs) for a long period like the one in the first graph 1946-2012 deal with that matter. And it is really preposterous to think that the average rate of 5.8% for a whole decade is a bounce back from the crisis."

ReplyDeleteBounce back explains a lot. If Argentina GDP per capita in constant prices in 1998=100, 2008=119.6, that is a growth rate of 1.8 percent which is probably about the potential growth rate of Argentina. Since then, it has been stop and go, first due to an external shock in 2009 and more recently due to suicidal exchange rate policies stalling the economy. Going forward, K growth is over, never more. You can bet the house on that.

"|The fact is that Argentina and Brazil grew more in the pre-1980s period because of the State-led policies,”

That is disingenuous. We had 15 years of near zero growth as hangover of those wonderful State-led policies.

“ and the retreat from neoliberalism has allowed for growth, stronger in Argentina because the retreat from neoliberalism was stronger.”

It is the bounce back and the fact that Argentina is less diversified than Brazil, so the terms of trade shock does more to growth. Of course, that is not praise for Brazil. We have a gigantic development bank, a suicidal level of contingent liabilities and have not had a single year of budget surplus since the beginning of times… We are not exactly Chileans.

“Finally, it's obvious that I was referring to changes in an index. Like the terms of trade is made 100 in 2005 so is the case with the real exchange rate. And for the period in question the Argentine one is more devalued.”

It is not much different if one uses the correct price indexes for Argentina, instead of the made-up INDEC ones. As for the current account balance, Argentina is on a bind because it cannot finance sustained current account deficits anymore (given their ‘great reputation’), so any shock to commodity prices requires disruptive contraction in imports, sharp devaluation or else the reserves go bye bye (well, Argentina can also follow Venezuela and Ecuador's example and take loans with the Chinese on shakedown terms). That is really not a comfortable position and without a doubt, that is not a basis for sustained growth.

"O" Anonimo:

Delete"Bounce back Explains a lot. If Argentina GDP per capita in constant prices in 1998 = 100, 2008 = 119.6, That is a growth rate of 1.8 percent"

Can you give the source of your data?

"which is probably about the potential growth rate of Argentina."

How do you compute that?

"That is disingenuous. We had 15 years of near zero growth as hangover of those wonderful State-led policies." You are right, you can use the state to avoid growth.

You can see this for Brasil: http://www.centrosraffa.org/public/1f2b998e-245f-4c3f-8a60-2814a0aa79a2.pdf

"Argentina is on a bind because it cannot finance sustained current account deficits anymore (given their ‘great reputation’), so any shock to commodity prices requires disruptive contraction in imports, sharp devaluation or else the reserves go bye bye (well, Argentina can also follow Venezuela and Ecuador's example and take loans with the Chinese on shakedown terms). That is really not a comfortable position and without a doubt, that is not a basis for sustained growth. "

That is why we say that we need an aggressive substitution policy.

You can see:

http://crisoleconometrico.blogspot.com.ar/2012/12/hacia-la-busqueda-de-una-estructura.html

Just one more thing, for you bounce back explains a lot because as an orthodox economist you do assume a natural rate and the notion that the system jumps back to its potential level. Yet, for both theoretical and empirical reasons extensively discussed in this blog, that idea is clearly untenable.

DeleteDo not fight against straw men.

DeleteI do not think 'the bounce back' comes naturally. There are things such as high unemployment stable equilibria.

That is why when economies have high unemployment, demand policies are effective.

That is also why the fixed exchange rate regime that Argentina adopted in the 1990s was wrong (they should have abandoned it after the Mexican crisis) - it placed monetary and fiscal policy on a straitjacket, with the consequences we all know (economic crisis first, rise of the political neanderthals later).

Sure that there is a high uneployment stable equilibria; it's what Keynes talk about in his famous quote from ch 18 of the General Theory (can send to you if you want). Mind you, economists like you get that because the natural rate is flexible (Gordon's TVNAIRU). But I'm glad you finally admit that demand policies are effective. Good for you, you're now a Keynesian at least in the short run.

DeleteComment with insults like the one you posted will be deleted. Keep clean dude. No need to be angry when somebody does not agree with you.

DeletePrezado Nahuel,

ReplyDelete“Can you give the source of your data?”

IMF WEO October 2012, series NGDPRPC

“How do you compute that?”

Two percent is the historical growth rate of output per capita in the technological frontier. Since I see no reason why Argentina should be closing their technological backwardness gap, I would guess 2 percent as an upper ceiling for Argentina’s potential GDP growth. Of course, that is optimistic. Ever since Freat Depression/Perón, the distance between Argentina and the technological frontier has increased, so if I am going to project the last 6-7 decades of historical evidence, I should pick a number lower than 2.

“That is why we say that we need an aggressive substitution policy.”

Here I think it is amazing that economists in countries like Brazil and Argentina still make this mistake – despite knowing the result of several decades of import substitution. What we need is the opposite of industrial substitution. In a world with increasing returns and a globalized economy, there is no more certain way to guarantee long-term backwardness than to substitute imports and attempt to diversify the economy by closing it. Switzerland does not have a textile, aerospace and auto industry – and that is exactly why the Swiss are rich and we are poor. We need to open to trade, close down the sectors that cannot compete and double up on the sectors that can.

Ok,

Delete"Two percent is the historical growth rate of output per capita in the technologicaso, if 1998=100, and suppose now that 2008=119.6l frontier."

so,

if 1998=100, and suppose now that 2008=119.6 is changed by other rate. You will say about the new rate: "which is probably about the potential growth rate of Argentina."

That is not scientific, that is a trick. Because that means that the rate of growth could be higher or lower according the "historical growth rate of output per capita in the technological frontier".

That rate could be higher if there is more autonomus demand = Exports, Public spending, R & D, etc.

The potential output is not exogenous:

http://crisoleconometrico.blogspot.com.ar/2013/02/histeresis-y-raices-unitarias.html

Autonomus demand led growth:

You can see Serrano (1996) his PhD dissertation.

"Switzerland does not have a textile, aerospace and auto industry – and that is exactly why the Swiss are rich and we are poor. We need to open to trade, close down the sectors that cannot compete and double up on the sectors that can. "

You are right again, we are poor because in aggregate terms, all countries can not be at the same time Switzerland.

All the countries cannot have surplus. And more important, if a country does not issue dollars, it needs import substitution and/or increase exports (but first, you need demand for those exports).

The problem is not if ISI has success or not, the point is, that countries like ours, need dollars (to buy capital goods, intermediate goods, pay debts) and you dont have the machine to issue them.

"We need to open to trade, close down the sectors that cannot compete and double up on the sectors that can. "

That is false/a myth:

http://www.amazon.com/Bad-Samaritans-Secret-History-Capitalism/dp/1596915986

There is no example in the world that shows success through open markets and free trade.

AND THIS IS A FACT.

If I am going to be strict about refuting your last paragraph, I use only two words: Hong & Kong.

DeleteNot all countries can be like Switzerland but Argentina can choose to continue to sink in the world rankings. All it has to do is to close its economy and attempt to diversify instead of specialize.

Your argument for import substitution was proven wrong in the 1960s. Argentina does not have a machine that makes dollars but it has a machine that makes soybeans that can be traded for dollars. Argentina would also have a machine that makes natural gas to turn into dollars but because Argentinean people have a fetish for voting on gangsters, that machine was broken.

I know the arguments by Ha-Joon Chang. Most of what he says is silly and some of it is dangerous, borderline evil (for instance, his position in favor of slavery and against human rights).

I also know Serrano's work. It is very funny stuff. Every time I read 'super multiplier' I cannot control myself. Cambridge economics is really hilarious.

@ Anonimo

DeleteThe Hong Kong card is a joke. You cannot view Hong Kong without an eye a) to it's history as part of the British Empire (no hint of free trade there) and b) to the hinterland of that small country called China without which HK would still be the barren rock it was 200 years ago.

And as for Switzerland, you're also wrong. It is actually highly industrialised and diversified considering it's such a small, high wage place. It has quite successful chemical, watch, machines, auto parts, aerospace, weapons and even textile industry (e.g. Alinghi sails). But apart from that, and similarly to Hong Kong, it feeds mainly off its status as a tax haven for multinationals and HNW individuals. Again, something that not all European countries can do simultaneously.

“The Hong Kong card is a joke. You cannot view Hong Kong without an eye a) to it's history as part of the British Empire (no hint of free trade there) and b) to the hinterland of that small country called China without which HK would still be the barren rock it was 200 years ago.”

ReplyDeleteI really do not understand your argument. How can you state that Hong Kong has not followed free trade policies? This is madness. We live on Planet Earth. In that planet there is a city-state that is widely known for being a free port. That is Hong Kong, one of the richest countries in the world, whose wealth was created based on a single comparative advantage: the absence of restrictions to trade.

“And as for Switzerland, you're also wrong. It is actually highly industrialised and diversified considering it's such a small, high wage place. It has quite successful chemical, watch, machines, auto parts, aerospace, weapons and even textile industry (e.g. Alinghi sails). But apart from that, and similarly to Hong Kong, it feeds mainly off its status as a tax haven for multinationals and HNW individuals. Again, something that not all European countries can do simultaneously.”

Switzerland has no industrial policy. It makes no effort to substitute imports. Its trade policy is free trade on almost everything (not for agricultural products) and very, very open financial markets. Yes, it is a financial center. But it had open financial markets before being a financial center, bwana. About the diversification, go calculate their Herfindahl indexes of exports… Please also do not even mention about Swiss textile industry. Go find out their trade balance on textiles.

You conflate the means by which both of these countries generated their strong positions in various sectors in the first instance with (some of the) the policies used henceforth to maintain their relative advantages. You also mistake carefully crafted bisopheres for regulatory arbitrage with free trade. You thereby define industrial policy far too narrowly, thereby reversing causation and arriving at the conclusion you so desperately seek.

ReplyDeleteHong Kong was an outpost of the British Empire that used the relative security of the natural harbour and the rule of (common) law as a basis for flooding China with opium from India in exchange for Chinese goods. It managed to maintain and expand its position as a regional port through a mixture of free trade for goods passing through (!), low corporate taxes (subsidised by monopoly rents on land) and completely manic infrastructure spending. It also has strict banking privacy laws. These, along with other interventionist policies, have made Hong Kong to the two trick pony that it is. A high risk strategy that has payed off so far. But certainly not the result of laissez faire politics. The one domestic market that really is free is the labour market. As a result, HK has the highest income inequality of all advanced nations so the fact that it has become a very wealthy place is not an accurate depiction of most citizens' daily lives.

As for Switzerland, it too boasts specific historic circumstances that led to the dominance of the^financial and chemicals / pharmaceuticals sectors. The chemical / pharmaceutical industry, mostly situated around Basle, is the direct result of the absence of patent laws well into the 20th century. It basically started as a bootleg version of its French counterpart across the border. The domestic market is still highly protected. There's a reason I pay more than twice as much as my fellow Germans, French or Italians for my Swiss made medication... The dominance of the financial sector is mostly a result of Swiss neutrality during WWII and its banking secrecy laws (i.e. they were Nazi bankers). And fiscal and monetary policies and interventions are dictated by these two sectors, mostly to the detriment of the manufacturing industries. Nothing free about that either. Switzerland also has a larger degree of regulatory and financial independence than its European counterparts because it isnt' part of the EU / EMU. The EU / EMU is therefore a much purer real world experiment on the effects of free trade than Switzerland is.

"The EU / EMU is therefore a much purer real world experiment on the effects of free trade than Switzerland is."

DeleteDo not conflate EU with EMU. Give me EU trade policies anytime. The typical EU country has per capita income 3 times as high as my country. The EU is awesome success story. It is very likely that I will not live to see my country reach the income levels of Spain today and I am still young (stupid monetary policies aside, giving up on one's own currency is an unforced error).

Both are also small countries. Why not do a comparison between countries of similar size to Argentina or Brazil, say UK and Germany?

ReplyDelete“Both are also small countries. Why not do a comparison between countries of similar size to Argentina or Brazil, say UK and Germany?”

ReplyDeleteThat is easy. Any of those countries are a lot closer to having free trade than Brazil – which is one of the countries with more trade protection in the world, and I am not even mentioning the natural trade protection that is provided by the distance from the main agglomerations of the world and our (Brazilian) long-term disregard for infrastructure (such as ports and roads).

And I am not even talking about financial policy. Brazilians cannot open a bank account in foreign currency. Not long ago, exporters were forced to bring their export receipts to Brazil (they could not just keep them abroad).

“You conflate the means by which both of these countries generated their strong positions in various sectors in the first instance with (some of the) the policies used henceforth to maintain their relative advantages. You also mistake carefully crafted bisopheres for regulatory arbitrage with free trade. You thereby define industrial policy far too narrowly, thereby reversing causation and arriving at the conclusion you so desperately seek.”

ReplyDeleteIt is the other way around. You call everything industrial policy. If everything is industrial policy, the term is ill-defined and becomes meaningless. That is the kind of reasoning that the Brazilian government and its defenders use when their detractors complaint that they are taxing workers to give subsidized credit to billionaires (‘Are you telling me that I cannot have State policies?’ ‘Mr. Batista, I have another billion dollars from the unemployment insurance fund. How about you start paying me back in 5 years?’)

“As for Switzerland, it too boasts specific historic circumstances that led to the dominance of the^financial and chemicals / pharmaceuticals sectors. The chemical / pharmaceutical industry, mostly situated around Basle, is the direct result of the absence of patent laws well into the 20th century. It basically started as a bootleg version of its French counterpart across the border. The domestic market is still highly protected. There's a reason I pay more than twice as much as my fellow Germans, French or Italians for my Swiss made medication... The dominance of the financial sector is mostly a result of Swiss neutrality during WWII and its banking secrecy laws (i.e. they were Nazi bankers). And fiscal and monetary policies and interventions are dictated by these two sectors, mostly to the detriment of the manufacturing industries. Nothing free about that either. Switzerland also has a larger degree of regulatory and financial independence than its European counterparts because it isnt' part of the EU / EMU. The EU / EMU is therefore a much purer real world experiment on the effects of free trade than Switzerland is.”

I do not understand your point. Switzerland is one of the most open countries in the world. Yes, the Swiss mess with the price of their milk products and subsidize agriculture but that is a small share of their economy. The country is so free trade that it became the most efficient ‘virtual entrepot’ of the world as you may well know. Some prices are high because of the non-traded component. If your Filipino grocery shop cashier earns as much as an Argentinean lawyer, then it is no surprising that you are going to pay a little more. But the Filipino grocery shop cashier in Switzerland earns so much only because Switzerland is so open, so productive that their firms are either globally competitive or cease to be. The contrast with Brazil or Argentina is blatant. A globally competitive firm in Argentina is a target for expropriation. A non-competitive firm in Brazil or Argentina is a target for government hand-outs (to their owners, of course).

Take the example of the auto industry in Brazil.

ReplyDeleteAuto production has economies of scale. But because of so much protection and subsidies to auto producers (tariffs are as high as 70%), practically all automakers have a plant in Brazil and none of the plants is globally competitive. That is a clear example where bad policy begets an equilibrium with low productivity. Without protection, car prices would be a lot lower in Brazil, most of those inefficient plants would not be here in the first place, and the few automakers that can withstand global competition would probably achieve economies of scale. Because of industrial policy, that is never going to happen. You can come back in 20 years, Brazil will still be producing cars, those cars will be expensive and crap, only Argentineans and look alikes would buy them, the profit will keep flowing to Germany and US… and our income levels will still be less than 25% of the income level in the US.

Which part of infrastructure spending is not industrial policy?

ReplyDeleteAnd how much of the financial regulation is a reaction to the inflation periods in the '80s?

I'll take your point that the Brazilian gvt. isn't the world's most innovative investor but I don't see how opening all floodgates will change that. Except by offering a vent through which wealthy individuals and corporations can can rescue their financial assets when the cumulative effects of their aggregate incompetence come tumbling down on them. Thus exacerbating the downturn to the detriment of those left behind. Or by adding incentive not to invest locally in the first place.

I think we're talking past each other, mostly for definitional reasons. I take most of your points, but I'm not sure they can be put down to a lack of free trade. And I will restate that an absence of intervention in trade flows might be a good way to maintain advantages that are already manifest but are not necessarily helpful for attaining the initial advantage. In fact, the two are just two sides of the same coin.

ReplyDeleteAnd the more you write, the more I'm convinced Brazil has a cronyism and corruption problem. Add the fact that you don't have autrocratic regimes like China that can maintain slave labour condition, sorry high productivity, as long as they like and you certainly do have a problem. My guess is, that if you lifted tariffs on the auto industry, you'd have your local production outsourced to China and India faster than you can say WTF.

“Which part of infrastructure spending is not industrial policy?”

ReplyDeleteAll of it? As I said, we have a problem with definitions, it is semantic.

What I call industrial policies does not include infrastructure spending.

In Brazil we should spend 2 or 3 times more in infrastructure spending, particularly in order to reduce the barriers to trade. But the left is and will always be against infrastructure spending. For practical reasons, because the left advocates for civil servants and more public infrastructure spending ultimately means that a tax auditor working for the federal government in Brazil will not be allowed to earn more than a 5 stars US general in Afghanistan. For ideological reasons, because the left believes that trade is bad (somehow) and that is why Brazil is one of the most closed economies in the world – any way you measure it.

And how much of the financial regulation is a reaction to the inflation periods in the '80s?

None of it. Believe it or not, that is a legacy from the 1930s. We still have not shredded the temporary emergency policies that we adopted during the Great Depression.

“I'll take your point that the Brazilian gvt. isn't the world's most innovative investor but I don't see how opening all floodgates will change that. Except by offering a vent through which wealthy individuals and corporations can can rescue their financial assets when the cumulative effects of their aggregate incompetence come tumbling down on them. Thus exacerbating the downturn to the detriment of those left behind. Or by adding incentive not to invest locally in the first place.”

Ok, so let’s keep doing exactly what our billionaires want… Let’s keep the economy protected, let’s keep discounting 8% (8 f*king percent!) from the paycheck of every worker and deposit in a fund managed by political hacks to lend at subsidized rates to those who do not need cheap money enter into leveraged buyouts of American firms…

I think the main problem of our discussion – and do not take offense, please – is that you do not seem to be very well informed about Brazil or Latin America. That is not uncommon because most of the information that is available abroad is garbage.

That is true, I'm not well informed about Latin America. But I am well informed about HK and Switzerland, having spent half my life in both places respectively. And most information about HK in particular is junk, too. :-)

Delete“And the more you write, the more I'm convinced Brazil has a cronyism and corruption problem. Add the fact that you don't have autrocratic regimes like China that can maintain slave labour condition, sorry high productivity, as long as they like and you certainly do have a problem. My guess is, that if you lifted tariffs on the auto industry, you'd have your local production outsourced to China and India faster than you can say WTF.”

ReplyDeleteI am not sure if I care. The auto industry came to Brazil 50 years ago. If they cannot make a product that is good enough to export, the logical conclusion is that the current system has failed. Will it change? I doubt it. The automakers and their unions are the most powerful political force in Brazil. They even made the president… The foregone opportunity was free trade with the US. We have passed it up, again for ideological reasons and because of the political power of industrialists and their unions in SP. Now Mexico seems to have moved to the frontier in car-making and we fell behind (I am not even comparing to Korea)… If we keep passing up the opportunities, the opportunities will keep passing.

I demand copyright! http://estructuradesequilibrada.blogspot.com.ar/2012/02/el-mito-del-viento-de-cola.html

ReplyDeleteLeaving the joke apart, this is a well know fact and claims about Argentina's growth being due to terms of trade or bounce back effect are either ideological or unserious (note also that in my post I show that the increase in soybean international prices was much lower than other commodity that latam countries export like copper or oil).