I am pleased to let you know that the 2023 Impact Factor for ROKE has gone up to 1.6 from 1.219. This puts us as one of the top heterodox journals. There are a few above, in my understanding, like the Cambridge Journal (2), and some incredibly good ones that were not ranked until recently, like the Review of Political Economy (now 1.5). One, of course, should take those ranks with some degree of caution. And old post on that here.

Thursday, June 29, 2023

Review of Keynesian Economics New Impact Factor

Friday, June 23, 2023

New directions in the Sraffian approach

Call for Papers (ROPE)

65 years after Production of Commodities by Means of Commodities: new directions in the Sraffian approach

Guest Editor: Santiago José Gahn

Internal Editor: Sylvio Kappes

The year 2025 marks the 65th anniversary of the publication of the book Production of Commodities by Means of Commodities by Piero Sraffa (1960). Not all economists are capable of transforming their name into a legacy, into a school. Piero Sraffa belongs to this select group. Exiled from fascism, he built his entire academic career at Cambridge University, where, from a profound analysis of the classical authors, he constructed a powerful critique of the dominant marginalist theory. But Sraffa's legacy has evolved into something much more powerful over the years, where some of his disciples have extended his criticism of marginalist theory, applied his ideas to international trade, and constructed alternative theories of economic growth.

65 years after Sraffa's publication, we believe it is necessary to launch a special issue that calls for reflection on his life, his political thoughts, his friendships, his lessons at Cambridge and his archive; his intellectual legacy, and that of his followers, and the impact on economic theory today; as well as possible guidelines for extending Sraffa's thought to other fields in the future. In recent years, Sraffa's legacy has had a boom that was born mainly in the periphery or the "global south", in particular in Argentina, Brazil and India. Recently, many authors have taken Sraffa's basic outlines and combined them with Latin American structuralist thinking in an attempt to explain the limits to growth and income distribution; they have developed and extended mathematical models of economic growth such as the Sraffian supermultiplier; they have presented the main limitations to Real Exchange Rate-led strategies, among other topics. Sraffa's legacy is alive and growing.

As a way of paying tribute to Production of Commodities by Means of Commodities (Sraffa, 1960) Review of Political Economy (ROPE) is preparing a special issue. This special issue intends to collect scientific articles that present or reinforce new lines of research within a Sraffian (or classical-Keynesian) perspective.

This special issue welcomes articles on a number of topics, including:

a. Sraffa's personal history, his relationship with Gramsci and his political thought.

b. Issues related to Sraffa's intellectual development, such as: extensions of PCMC, critique of mainstream theory, analysis of Sraffa’s archive.

c. Sraffa’s intellectual legacy: the direct impact on their followers such as Garegnani and Pasinetti, among others.

d. New directions in the Sraffian approach: extensions of the Sraffian supermultiplier model, endogenous money, international trade, imperialism and unequal exchange, the method in economics, impact of economic policies on gender, race or climate change. Articles that can extend Sraffian school to Anthropology and Sociology are also welcome.

Of course, all these topics can never cover the vast universe of the impact of Sraffa's intellectual legacy, but all articles that relate to Sraffa's thought are welcome, including critical ones as well. Finally, this special issue will attempt to have a gender balance.

If interested in submitting a paper, please send a short abstract by September 15th, 2023 to both Santiago J. Gahn (santiago.gahn@uniba.it) and Sylvio Kappes (sylviokappes@gmail.com). Decisions will be made by September 25th, 2023. If selected, the complete paper must be sent by May 1st, 2024.

Deadline for submitting abstracts: 15th September 2023

Deadline for submitting papers: 1st May 2024

References

Sraffa, P. (1960). Production of Commodities: Prelude to a Critique of Economic Theory. Cambridge University Press.

Wednesday, June 21, 2023

Unmasking Inflation: Why the Conventional Wisdom is Failing Us

Interview I gave for INET in January. From their website:

Matías Vernengo navigates the complex topic of inflation, discussing its implications on workers, and the economic policies that can potentially mitigate these effects. He explains the inflation of the 1970s and compares it to the more recent inflationary scenario provoked by global events. Vernengo evaluates the mainstream explanations - demand-pull and cost-push theories - and presents an alternative, heterodox explanation that views inflation as a result of distributive conflict and corporate power. While he acknowledges the role of corporations, he emphasizes that it’s the effects of inflation, primarily on workers’ real wages, that require addressing. He argues that the best policy would be to compensate workers for these effects. Vernengo’s analysis covers not just the American context, but also examines inflation in peripheral economies like Argentina and Turkey, identifying a link to exchange rates. He also critiques the “one-size-fits-all” theory approach to understanding inflation, underscoring the need for a heterodox economics perspective that could offer more nuanced insights and potential solutions.

Monday, June 19, 2023

Special Issue of the Review of Keynesian Economics

- The relevance of the center-periphery analysis and/or its limitations;

- Income and/or wealth distribution: the distributive and redistributive effects (in central and peripheral countries) of the neoliberal globalization;Debt tolerance/financial crises: the destabilizing role of central monetary policies on the peripheral economies;

- International political economy: the ongoing reconfiguration of center-periphery relations;

- Decoupling of a global West from an emerging Asia; future and crisis of globalization;

- The inherent fragility of global supply chains;

- Any other topic related to the center-periphery analysis in a classical-Keynesian perspective.

Submissions should be made using the usual channels of the journal, and they will be managed jointly by editors and guest editors. All accepted articles will be published in the special issue.

Deadline for submissions: November 30, 2023. For further information, please contact the Guest Editors: Matias Vernengo (Bucknell University, U.S.A.; mv012@bucknell.edu) and Roberto Lampa (University of Macerata, Italy; r.lampa@unimc.it)

Sunday, June 18, 2023

A New Turn to the Left in Latin America?

Special issue of Cuadernos de Economía, to be co-edited by Esteban Pérez and myself. Deadline is December 15.

Friday, June 16, 2023

How tight is the labor market?

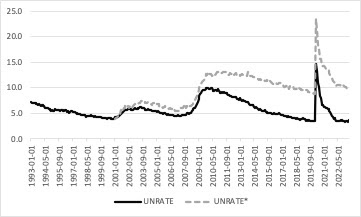

Inflation is coming down, as the last BLS report shows. I'm not going to get into that into this (very short) post. The disinflation has taken place while the official unemployment remains very low. However, we all know that unemployment measures very poorly the situation in the labor market. My alternative measure, which I make students calculate in macro classes, is what would be the unemployment rate be if the participation rate, which has been declining since the early 2000s (when China entered the WTO; see on that and deindustrialization this very old post), was the same of the last peak (back at the end of the Clinton era) when it was at about 67 percent (see below).

Note that the unemployment rate has a negative relationship with the participation rate, everything else constant. The result below.

The answer is, not 3.7 percent, but around 10 percent. In other words, there's a lot of what Joan Robinson used to call disguised unemployment. Discouraged workers that are not searching for a job, because they can't find anything worthwhile, and, hence, do not count as unemployed. This can be seen as the extra unemployment that we have because of the neoliberal policies of the last four decades, but in particular after the more radical opening to China starting in the 1990s.

Monday, June 12, 2023

More on oligopolistic inflation (Greedflation)

Marc Lavoie has written this post on the current inflation debates, which received some attention. We had a conversation (I don't say debate because we mostly agreed, and the video is here, last September). I also recommend Julia Braga and Franklin Serrano's paper on Marc's chapter on inflation, which is relevant for the current debates. The debate rages, within heterodoxy, as if a lot of the ideas are new, but quite frankly they are a recap of discussions of the past, particularly for those that dealt with the extensive debates about inflation and hyperinflation in Latin America in the 1980s and 1990s.

That demand-pull inflation was not the cause of inflation, I think is accepted among heterodox authors, and increasingly so within the mainstream or at least the media, that mostly covers the mainstream. After an initial idyll with Larry Summers and the notion that excessively large fiscal packages during the pandemic had caused inflation, now his view that a prolonged period of relatively high (or at least higher) unemployment was necessary for stabilization has fallen out of favor. Disinflation has taken place with relatively low levels of unemployment (which, it's worth remembering measure very poorly the conditions in the labor market in our neoliberal era, and where there is more slack than noted due to significant numbers of discouraged workers). The coverage has changed from thinking Summers was right to dismissing his views. He was wrong both times.

I'm more concerned with the dominant view among progressives that inflation was caused by higher profit margins, associated to the excessive power of corporations. Something that has been called greedflation, by many commentators (see Robert Reich's recent column here), and that back when, in a distant past in another galaxy, we called oligopolistic inflation. So this is mostly a debate between neoliberal and progressive Dems (Republicans have been less relevant; for their view go to this conference/book including John B. Taylor, John Cochrane and others at the Hoover Institution; not very different than Summers, who was at the conference, at least conceptually, even if more hawkish, if that is possible).*

In particular, I think the main remaining issue is the question of the role of mark ups, or profit margins in the inflationary process. As I noted before, the idea of oligopolistic inflation is in some sense a reaction to the notion that wage resistance and wage-price spirals would imply that workers are responsible for inflation (in this reading as much as demand-pull inflation would require unemployment for stabilization, conflict inflation would imply the need for wage stagnation). Some heterodox economists have even suggested that wage-price spirals are sort of a myth.

Note that when workers manage to increase wages, then price making firms will try to recompose their margins and increase prices. And if workers are not satisfied, as prices go up again and real wages fall, then you get a spiral. Hence, the wage-price spiral is a reflection of distributive conflict, and that workers and capitalists are not satisfied with their relative shares. In that sense, inflation is neither wage-led nor profit-led, like accumulation can be. It is the result of incompatible income claims by both classes.

There is a simple model in this old paper for the Handbook edited by Phil Arestis and Malcolm Sawyer, in which I discussed the three causes of inflation for heterodox authors, supply shocks, inertia and conflict.

* The inflation paranoia is somewhat surprising, with Taylor saying that: "The answer to the key question, 'Are We Entering a New Era of High Inflation?' is clearly 'yes,' unless monetary policy makers change policy." Note that this is not new. The late Allan Meltzer warned against the dangers of excessive monetary expansion after the 2008-9 crisis, saying back then: "the enormous increase in bank reserves —caused by the Fed’s purchases of bonds and mortgages — will surely bring on severe inflation if allowed to remain." So, you would have to really believe in the lags in monetary policy (more than a decade) for his prediction to make any sense.

.png)